On September 14th, there will be a subsequent meeting of the Board of the National Bank of Ukraine focused on monetary policy. The most anticipated item on the agenda is the policy interest rate. The regulator’s latest decision in July to lower the key interest rate by 3 percentage points for the first time since the onset of full-scale aggression was met with mixed reviews by experts. On one hand, the National Bank of Ukraine aimed to demonstrate a disinflationary trend and acknowledged a substantial level of foreign exchange reserves. On the other, the mere 3 percentage point reduction was partially perceived by the market as a half-measure and indicative of the central bank’s uncertainty in maintaining the stated trends.

The key rate of 25% had been in effect for one year and two months. It was set at this level in June 2022 in response to the heightened impact of active military actions in Ukraine on the state of the monetary and credit market, the decline in international reserves, and to counter inflationary trends and currency risks through tightening monetary conditions.

During the period of the 25% rate (from June 2022 to June 2023):

The interest rate for fixed-term hryvnia deposits by the population increased from 6.1% to 13.7% per annum;

The yield on hryvnia government bonds increased from 10.8% to 18.9% per annum;

The proportion of fixed-term hryvnia deposits in the total deposits of the population started to grow over the last 5 months;

Fixed-term hryvnia deposits from the population increased by 38 billion hryvnias.

At the same time:

The interest rate on hryvnia business loans rose from 13.9% to 20.3% per annum;

Hryvnia business loans declined by 25 billion hryvnias.

Is a rate cut in the offing?

The formed disinflationary trend in the economy and stability in the foreign exchange market have led to the possibility of lowering the key rate. The NBU had previously planned to shift to an easing cycle of monetary policy in the second half of 2024, aligning with the hawkish strategy that the NBU has traditionally adhered to. This timeline would allow for a confirmation of the disinflationary trend. However, on July 27th, the NBU board decided to reduce the policy rate to 22% per annum.

Aiming for a lower policy rate, sometimes significantly below inflation, is a dovish strategy, followed by several central banks, including those in European countries.

However, the NBU’s decision does not align with either of these strategies. On one hand, the NBU began lowering the rate earlier than anticipated in its previous forecasts. On the other hand, the rate is still considerably higher than both the actual and projected inflation rates.

Meanwhile, the Ministry of Finance maintains a “stoic” stance, keeping yields on its government bonds largely unchanged, effectively not reacting to changes in macroeconomic conditions. This allows to attract significantly larger volumes of funds in the domestic market under improved macroeconomic and financial conditions.

Monetary Policy Design and Ukrainian Realities.

Does the decision regarding such a cautious rate reduction align with strategic objectives? The question is not straightforward as there are too many variables in the calculation of the key interest rate.

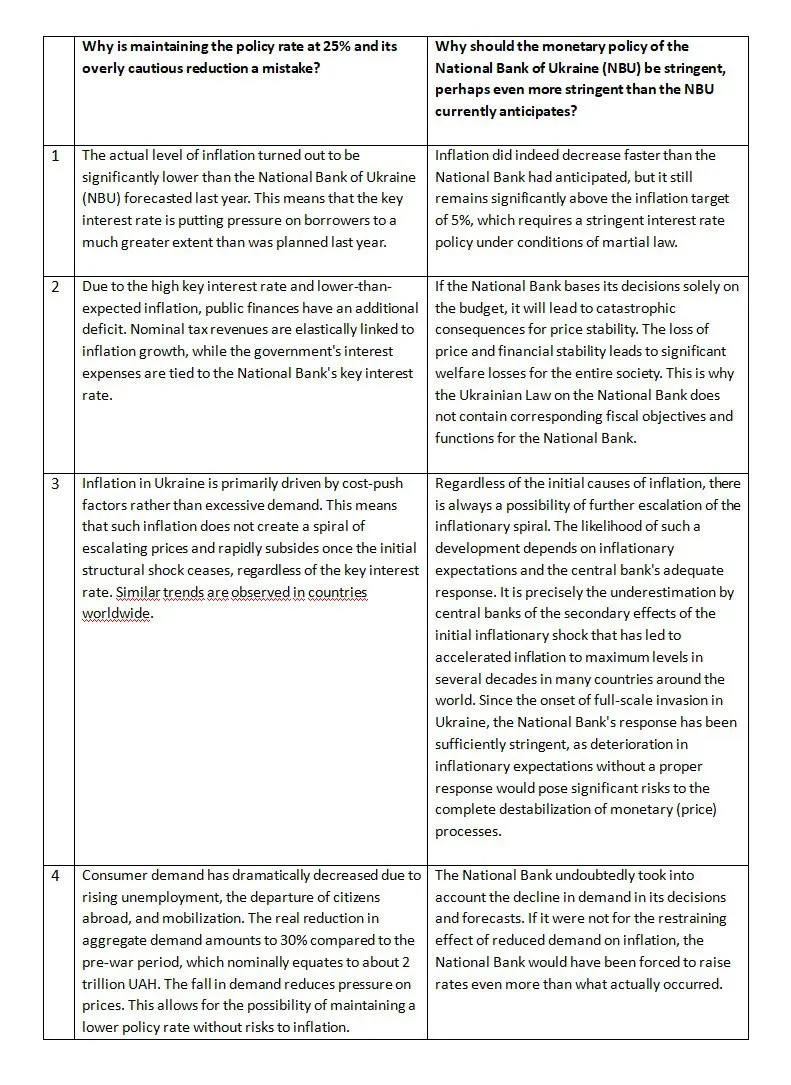

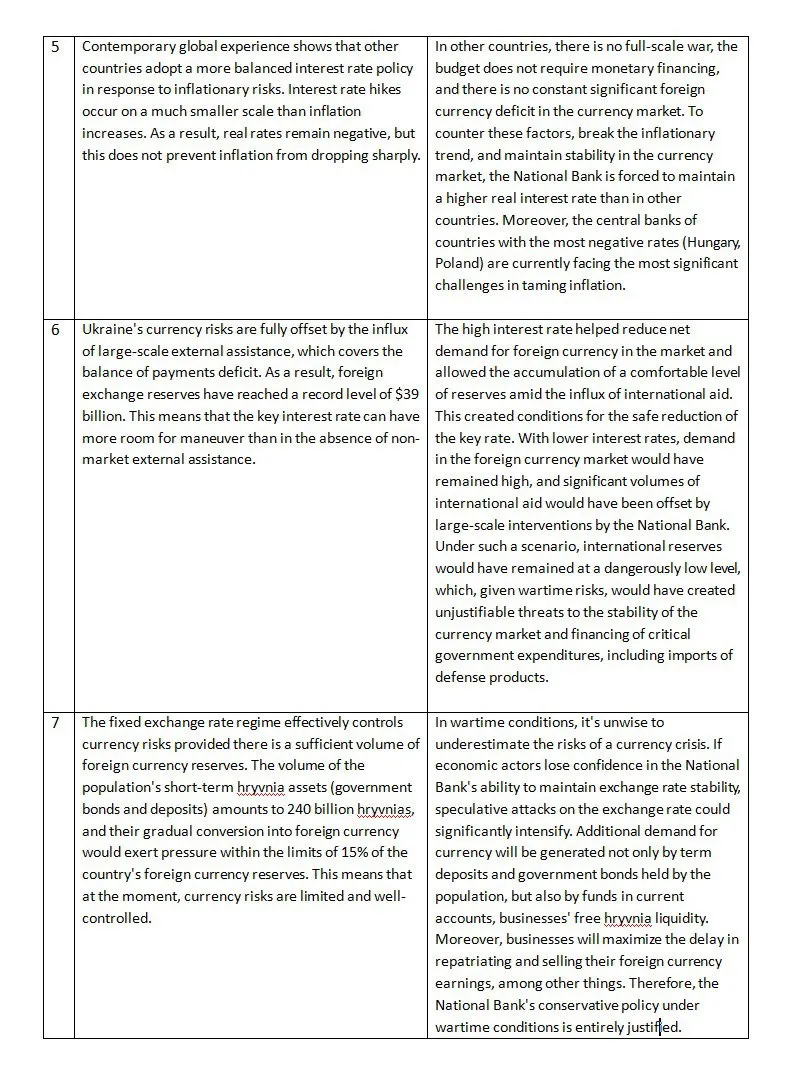

Critics of an overly strict monetary policy provide numerous arguments against maintaining the 25% rate and its cautious reduction, which the NBU initiated in July. However, each of these arguments can be countered, and every counter-argument can support an even more cautious approach than the one currently proposed by the NBU. The table below lists these arguments and counterarguments:

In the conditions of a wartime period, the level of the key interest rate should be determined by taking into account a wide range of factors, including both inflation dynamics and factors of macro-financial stability. Most importantly, the actions and steps of the regulator must be consistent and understandable to the market, which is an exceedingly complex task for the NBU today, against the backdrop of an already diverse design of monetary policy. The so-called ‘premature’ reduction of the policy rate by 3 percentage points, in the grand scheme of things, hasn’t changed anything in relation to the NBU’s monetary policy from the perspective of those advocating for stimulus through monetary measures. Nevertheless, such a decision by the NBU is no longer evidence of the NBU’s strict stance to maintain tight monetary conditions necessary for ensuring the stability of the foreign exchange market and a stable disinflationary trend even in the conditions of a full-scale war.

Source: Medium